MICROELECTRONICS Fostering Growth Opportunities in the Ultrapure Water Market [Sep 2011]

By admin September 26, 2011 10:01 am IST

Sustainable development in the Ultrapure Water market goes hand-in-hand with the electronics market. Presently, the major application of Ultrapure Water is in the power industries, pharmaceuticals, and laboratory work. But, there can be a drastic change in the scenario with the establishment of new fabs and PV manufacturing units.

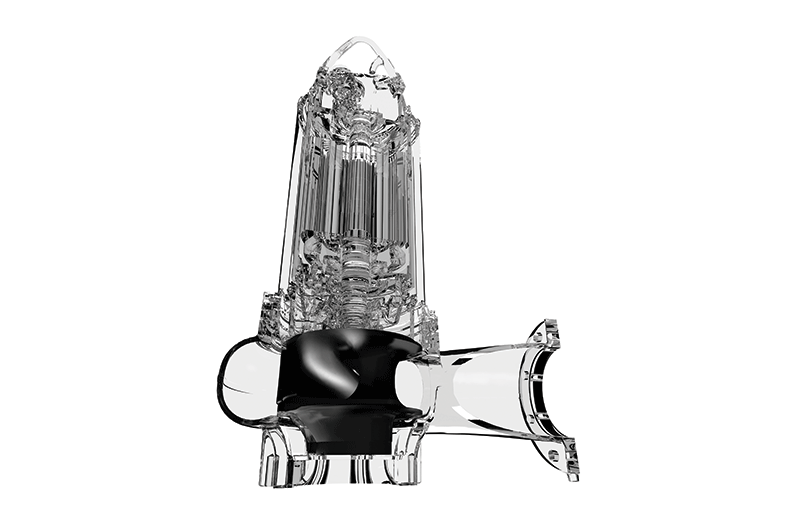

Ultrapure Water RequirementsThousands of gallons of water are required to produce one silicon wafer. Wafers are building blocks in the electronics industry. Estimates reveal that the electronics market in India will grow to $400 billion by 2020, of which chips will account for US $50-60 billion. The chip consumption in India has increased by 61.44 per cent to $8.25 billion in the past two years. Consequently, high-purity water generation would require a large investment. For instance, one 200-milli metre semiconductor wafer that powers home computers requires 7,500 gallons of Ultrapure Water. The purity of Ultrapure Water is calculated in ppb (parts per billion); contrary to potable water, whose purity is limited to ppm (parts per million) or milligram per litre (mg/l). The purity of water required in the microelectronics industry can be very high and Ultrapure Water is the solution for this. Reverse Osmosis (RO), alone, is not sufficient to achieve such high level of purity. Along with RO, methods such as ultrafiltration, deionisation, and UV sanitisation are adopted to achieve the required specifications.

The line width of microelectronic devices has decreased to .2μm and is supposed to go down to nanometres. Under these conditions, even a particle of size half the line width will become a large impurity. So, the water used needs to be of very high purity, for instance, Ultrapure Water. Another issue is the quantity of water required. Modern fabs (semiconductor manufacturing facilities) and photovoltaic (PV) manufacturing can consume 1 to 3 million litres per day of Ultrapure Water. Every step of production requires a lot of water for cleaning purposes. Currently, most end users treat water to a level required for safe discharge to the environment or to be reused for gardening purposes. However, going forward, it is anticipated that zero liquid discharge systems to reclaim the effluent will be in demand, considering the evolution of discharge standards and water scarcity issues prevailing in India.

Policy Initiatives to Spur the Ultrapure Water Treatment MarketIn addition to its requirement in chip manufacturing, Ultrapure Water is also used in large quantities in solar photovoltaic (PV) manufacturing industries. PV is used to trap solar power and in a subtropical country like India there is abundant sunshine throughout the year. Considering the pollution from fuels, carbon emissions, and the need for an alternate source of energy, the Indian Government has unveiled a National Solar Mission – a US $19 billion plan to generate 20 GW power by 2020. Since then, many large and small companies have entered the solar PV market with products ranging from solar cells, to solar modules and panels.

The Government drafted the Semiconductor Policy in 2007 with an attempt to attract manufacturing companies to set up manufacturing facilities or ‘fabs’ in India, but the attempt was a failure, as the incentives provided were not sufficient. Moreover, the global downturn in 2008 triggered a slowdown across all key sectors, including semiconductors. The countries like China, Thailand and Singapore offered better options and infrastructure to chip-making companies and India had to depend on imports from these countries.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.