Manufacturers face data woes that stifle innovation and time to market

By OEM Update Editorial March 11, 2024 7:08 pm IST

Major challenges with data availability and quality are impeding the roll-out of advanced technology such as digital twins, automation and AI in manufacturing.

Manufacturers that fail to get their data in order risk being left behind their rivals, a new report from Hexagon reveals. The global survey of more than 500 manufacturing leaders, conducted by Forrester Consulting and commissioned by Hexagon, found that 98% of manufacturers report at least one issue with data within their organisation. Leaders are considering real-time collaboration, AI and automation, but persistent data challenges stifle innovation and impede the roll-out of such advanced manufacturing technologies.

The Advanced Manufacturing Report uncovers evidence of fundamental shifts in how high-value products are designed and manufactured through three fundamental digital enablers – data quality and availability, workforce collaboration and empowerment, and automation.

Data utilisation and collaboration – manufacturers’ big headache

These data woes contributed to 97% of manufacturers facing challenges in collaboration and productivity, which can impact their ability to innovate and delay responding to customers’ needs. The majority of business leaders realise that better collaboration can improve product quality (88%), time to market (86%), also improve sustainability – with 82% of respondents believing better communication between design and manufacturing teams can significantly reduce material waste and emissions. Despite this, almost three-quarters (71%) of business leaders are concerned about the lack of synergy between their design and manufacturing teams.

Josh Weiss, president of Hexagon’s Manufacturing Intelligence division, comments: “It’s ironic that manufacturing invented the automation and agile practices that are driving business transformation in other industries and is now struggling to transform – but that’s because achieving digitalisation throughout manufacturing value chains is a very real, complex, and human challenge. Digital twins are crucial to making factories smart, they enable teams to solve problems across departments, to innovate, and that same high-quality data underpins productivity-superchargers such as AI and robotics.

“Those that empower their organisation to use data right now can drive more efficient value creation and get products to market faster with the agility to adapt to market conditions. We saw it when consumer electronics led the shift to rapid product innovation, and now BYD has shaken the automotive sector by overtaking Tesla as the electric vehicle market leader, emphasising the need to transform productivity and innovation throughout the manufacturing value chain.”

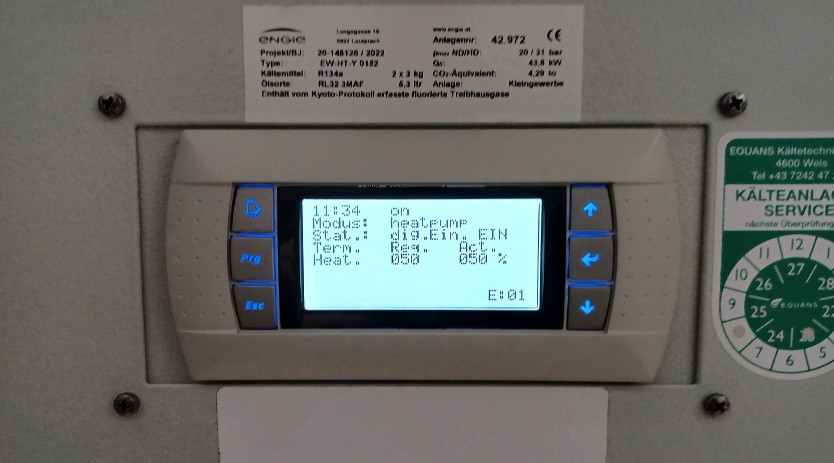

The research surveyed manufacturing leaders from North America, Asia and Europe. 24% of respondents were C-level executives. It found that while access to high-quality data appears to be a universal issue, Asian manufacturers are more confident applying their data – for example using simulation, virtual manufacturing and predictive maintenance to predict and avoid problems downstream when the financial impacts can be severe.

Digitalisation leaders surge ahead with data underpinning time to market and Industry 5.0

With only 2% of manufacturers claiming to be problem-free with their data practices, a vast majority of companies risk missing their business goals if they fail to act now. Manufacturing business leaders cited improving operational efficiency, increasing manufacturing output and improving the quality of new products faster, as their top business priorities for the next three years – all of which could be impeded by not making the organisation-wide cultural and technical changes required to succeed with digitalisation.

The findings also indicate that 37% of manufacturers are falling behind their rivals and should be considered ‘laggards’, as they have failed to highly or fully automate any phase of their manufacturing process. This is compared to a quarter of manufacturers that should be considered the ‘leaders’ in the market, as they have highly or fully automated at least two phases of their manufacturing processes.

The research indicates that industry leaders have a clear advantage in terms of workforce productivity and efficiency compared to laggards. Specifically, 58 percent of leaders report experiencing increased staff productivity and innovation, whereas only 35 percent of laggards report the same. Additionally, 39 percent of leaders are successful in effectively addressing talent shortages, while only 26 percent of laggards are able to do so. These findings highlight the importance of adopting strategies and practices that foster productivity, innovation, and talent management to maintain a competitive edge in the industry.

Manufacturers globally are looking to advanced automation technologies to boost productivity. Interestingly, 58% of Asian companies plan to invest in AI-powered, or generative, automation over the next three years compared to less than half of manufacturers in North America (45%) and EMEA (38%).

The research was commissioned by Hexagon and conducted by Forrester Consulting in May 2023 to understand how technology is shaping their strategies today and for the future. The Advanced Manufacturing Report provides in-depth analysis throughout the value chain from product design to finished product and quality processes, spotlighting trends and providing valuable insight into the challenges manufacturing leaders face, their successes and new opportunities.

Explore the Advanced Manufacturing Report findings at: https://hexagon.com/advanced-manufacturing-report

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.