Indian auto component industry grows 65% to ₹1.96 lakh crore

By OEM Update Editorial January 10, 2022 11:20 am IST

Industry cautiously-optimistic about the near to mid-term future and most auto component manufacturers are preparing to be part of the EV supply chain.

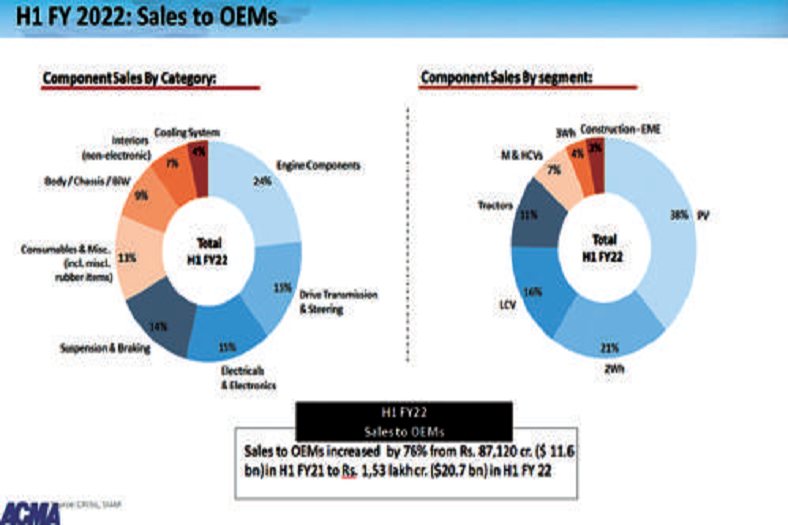

Automotive Component Manufacturers Association of India (ACMA), the apex body representing India’s Auto Component manufacturing industry announced the findings of its Industry Performance Review for the first half of fiscal 2021-22. The turnover of the automotive component industry stood at ₹1.96 lakh crore (USD 26.6 billion) for the period April 2021to September 2021, registering a growth of 65 percent over the first half of the previous year.

Commenting on the performance of the auto component industry in India, Vinnie Mehta, Director General, ACMA said, “Despite the slow offtake in vehicles sales due to supply side issues, especially in the first quarter, the auto component industry demonstrated a remarkable turn-around in the first half of FY 2021-22. With significant growth in all segments – supply to OEMs, exports as also the aftermarket, the component industry grew to ₹1.96 lakh crore (USD 26.6 billion) registering 65 percent growth. Exports grew by 76 percent to ₹68.7 lakh crore (USD 9.3 billion) while imports grew by 71 percent to ₹64.3 lakh crore (USD 8.7 billion) leading to trade surplus of USD 600 million. The Aftermarket, estimated at ₹38,895 crore also witnessed a steady growth of 25 percent. Component sales to OEMs in the domestic market grew by 76 percent to ₹1.53 lakh crore”.

Sharing his insights on the performance of the auto component industry, Sunjay Kapur, President, ACMA said, “Despite resurgence of demand for vehicles, supply-side issues of availability of semiconductors, increasing input costs, rising logistics costs and availability of containers, among others, continue to hamper recovery in the automotive sector. The auto component industry, in this backdrop, displayed remarkable resilience. Increased value-addition to meet regulatory compliance, fast recovery in external markets and traction in the domestic aftermarket market have contributed to the growth of the sector in the first-half of FY 2021-22.

Going forward, whilst the performance of the vehicle industry during the festive season has not been on expected lines, however there are indications that the vehicle demand, in the coming months, will improve. This, together with the increased focus by the auto industry on deep-localisation and the recent announcements by the of PLI schemes by the Governmenton Advanced Chemistry Cell (ACC) Batteries and Auto & Auto Components will facilitate the creation of a state-of-the-art automotive value chain and developing India into an attractive alternative source of high-end auto components.”

Elaborating on the mood of the industry and outlook for the near to mid-term future, Sunjay mentioned, “According to a recent survey of ACMA leadership, despite concerns of another wave of pandemic, the industry is cautiously optimistic about the prospects of the Indian economy and the automotive sector for FY 2021-22. Auto component manufacturers have now, by and large, recovered and the investment cycle has also commenced. On the subject of the auto component industry preparing to be future-ready, 60 percent of the respondents mentioned that they were already equipped to be part of the EV supply chain, while the rest would be ready in the next two odd years.”Key findings of the ACMA Industry Performance Review for H1 2021-22:

- Exports: Exports of auto components grew by 76 percent to ₹68,746 crore (USD 9.3 billion) in H1 2021-22 from ₹39,003 crore (USD 5.2 billion) in H1 2020-21. Europe, accounting for 31 percent of exports, saw an increase of 81 percent, while North America and Asia, accounting for 32 percent and 25 percent respectively, also registered an increase of 81 and 73 percent respectively.

- Imports: Imports of auto components grew by 71 per percent from ₹37,710 crore (USD 5.0 billion) in H1 2020- 21to ₹64,310 crore (USD 8.7billion) in H1 2021-22. Asia accounted for 63 percent of imports followed by Europe and North America, with 29 percent and 7 percent respectively. Imports from all geographies witnessed steep increase reflecting growth in domestic manufacturing activities.

- Aftermarket: The aftermarket in H1 2021-22 witnessed a growth of 25 percent to ₹38,895 crore (USD 5.3 billion) from ₹31,116 crore (USD 4.1 billion) in H1 2020-21.

Final note: The Turnover data represents the entire supplies from the auto component industry (ACMA members and nonmembers) to the on-road and off-road vehicle manufacturers and the aftermarket in India as well as exports. This also includes component supplies captive to the OEMs and by the unorganized and smaller players.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.