Good days ahead for Switchgear manufacturing

By OEM Update Editorial August 23, 2022 11:32 am IST

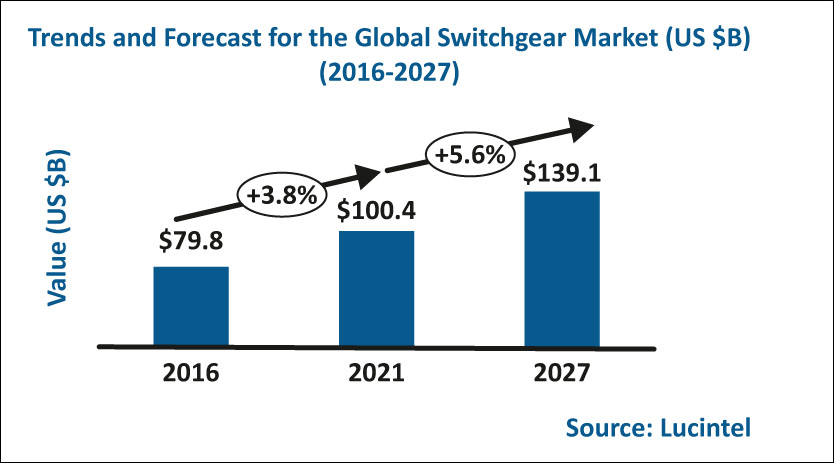

Emerging trends directly impact the dynamics of the industry. The global switchgear market is expected to reach an estimated $139 billion by 2027.

The future of the switchgear market looks attractive with opportunities in the utilities, industrial, residential, and commercial sectors. The firms are contracting for more renewable electricity, and consumers are continuing to install substantial numbers of solar panels, all of which are driving rapid adoption. This scenario will benefit the global switchgear industry as the need for green and clean energy rises. The global switchgear market is expected to reach an estimated $139 billion by 2027 and is forecast to grow at a CAGR of 5.6 per cent from 2021 to 2027. The major drivers for this market are increasing demand for electricity, growing implementation of smart grid technology, and continuing investment in upgrading transmission and distribution systems.

Switchgear market by insulation and type

The intelligent switchgear business is expanding rapidly with continual advances in infrastructure and production facilities. Smart switchgear, which plays an essential part in energy distribution to industry and residential areas, is one of the sector’s most critical stimulants. As a result, implementing smart power distribution devices such as intelligent switchgear is essential in ensuring increased performance, power continuity, and resource optimization while lowering the transmission, operational, and maintenance costs. New smart switchgear is flexible, energy efficient, and future-proof. They offer update and upgrade solutions with zero downtime; these technologies are expected to grow significantly in the future and provide growth opportunities.

By insulation and type, the switchgear market is expected to grow from an estimated USD 90.9 billion in 2022 to USD 120.1 billion by 2027, at a CAGR of 5.7 per cent during the forecast period 2022-2027, according to the Markets report. The equipment to make smarter decisions by providing realtime data to reveal problems and improvement opportunities is the major factor driving the market of Switchgears. Switchgear manufacturers faced many supply chain constraints during the pandemic, especially in base metals (copper, aluminium, steel), plastics, semiconductors, and transportation services. The effects of the pandemic resulted in a significant decline in manufacturing and industrial activity, impacting the switchgear market directly, as it is primarily employed in such industries and manufacturing units.

In an industrial setting, the biggest challenge lies during arc flashing and overpressure during operation is risky. Voltages and currents are much higher in a commercial or industrial setting, so electrical breakdowns often release more energy. As a result, an arc flash frequently results in a tremendous explosion accompanied by scorching heat, toxic chemicals, blinding light, deafening noise, and massive pressure waves.

Gas-insulated switchgear segment by insulation to grow at a high CAGR

Based on the insulation, the gas-insulated switchgear is estimated to be the fastest-growing market from 2020 to 2027. They are deployed in various industries, serving different needs at varying voltage levels. GIS uses sealed enclosures filled with sulfur hexafluoride or a mixture of SF6 and other insulating gases. Continuous current and interrupting ratings for GIS are typically limited to 3,000 A and 40 kA. This switchgear has a higher upfront cost than AIS offers better efficiency, protection, less maintenance, and less space. Hence, utilities are increasingly using them in substations. Also, rising electrification, especially in the developing and newly industrialized regions of Asia Pacific, further fuels the demand for GIS.

AC segment to emerge as the largest

Based on the current, AC is projected to hold the highest market share during the forecast period. AC switchgear power systems are used by utilities, industries, businesses, and residential buildings to provide protection, isolation, and control for electrical systems. AC power can travel great distances without a power loss, ultimately allowing for a lower-cost power supply. Much of the power generated by utilities is AC, making the AC segment dominant in the switchgear market. The increasing adoption of renewable energy sources for power generation makes it necessary to upgrade the current infrastructure to allow easy integration of the electricity generated from renewable sources. Developing countries, especially in the Asia Pacific and South America, aim to achieve 100 percent electrification and, as a result, are working extensively towards expanding the current infrastructure. These factors are expected to drive the growth of the transmission & distribution utilities.

The Asia Pacific accounts for the largest market

The Asia Pacific region is expected to dominate the switchgear market during the forecast period. According to the International Monetary Fund, the economy of the Asia Pacific region is estimated to grow by 4.9 per cent in the fiscal year 2022. Furthermore, population growth in the area increases the burden on the housing infrastructure and will compel economies to focus on expanding public housing infrastructure. The continued growth in the Asia Pacific region in almost all major industrial sectors is expected to drive the demand for switchgear during the forecast period.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.