GST impacts: Things that changed after the new tax regime

By OEM Update Editorial September 11, 2017 2:42 pm IST

An in-depth report on the things changed after the new tax regime i.e. GST

Earlier, it was demonetisation that took place last year and now it is Goods and Services Tax (GST), baffling taxpayers with the scope of changes it brings.

Goods and Services Tax (GST) is an indirect tax which was recently launched by Prime Minister Narendra Modi on July, 1, 2017 and was applicable throughout India which replaced multiple cascading taxes levied by the central and state governments. Featuring few changes that took place in this aspect.

A bold move

The GST is a major financial change that occurred to India in decades. It has been hardly a month since the Goods and Services Tax (GST) has been introduced to Indian financial system. “We must admit that the move is really bold. Though it takes tremendous amount of efforts every month, the processing work it has increased in abundance, “says Maulik Patel, Executive Director, Sahajanand Laser Technology Ltd.

Patel adds, “If bypassing through all, we are achieving our economic ambitions, then it worth’s every effort. In such a short span it would be too early to register any inclination or declination in general sense, let alone speak of change. All we can look forward to a desired outcome in long run from this paradigm shift.”

Huge relief for industries and customers

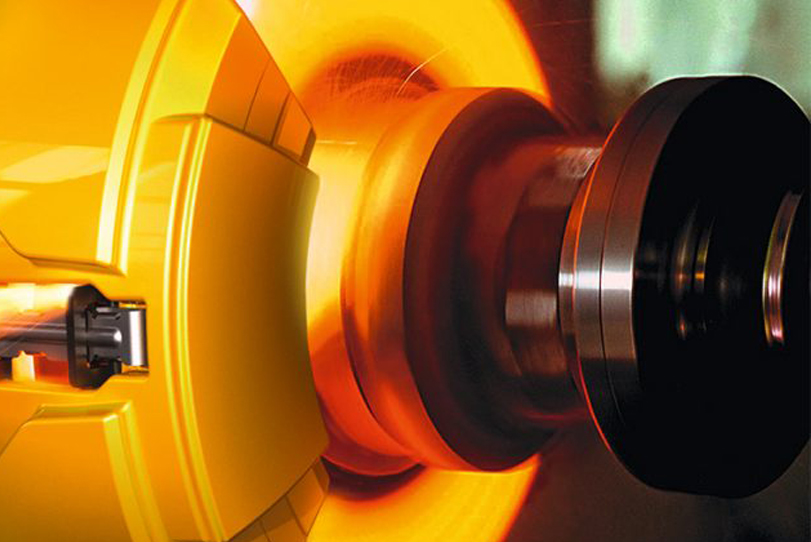

“Since 85 per cent of our domestic sales are inter-state, an additional 2 per cent CST against C Form was levied on the end customer. It has now been replaced with IGST, which is fully available for set-off, thereby helped in reducing cost. Additionally, it has resulted in the elimination of the C form filing process which is a huge relief for industries and customers,” says T.P Sridhar, CEO, Ace Designers Ltd.

He adds, “In some states, machinery purchases were liable for an additional entry tax ranging from 2-4 per cent. Post GST there is no entry tax liability across India, which has helped in reducing cost of our products.”

Sridhar informs, “Most of the capital goods manufacturers were under inverted tax structure, where the Input VAT was higher than the Output VAT liability, which used to result in excess payment input VAT credit, leading to blocking of working capital and incurrence of additional finance cost to every machine tool manufacture, with GST this structure no longer exists.”

Ease of doing business in India“It’s an appreciable initiative taken by the Government. The introduction of this GST regime is seen as one of the biggest business reform as against tax reform. This has simplified the whole process of doing business in India,” says Ram Grover, Managing Director, Elesa and Ganter India Pvt Ltd.

Grover adds, “Now we have a uniform tax on goods and services and no more hidden taxes as a surprise. With GST, the customer can be assured that the product have been taxed at a single tax bracket, split between the centre and the state.” “Implementation of any new system in the business is always tough but should be easily accepted if productive in long-run.”

Real time change

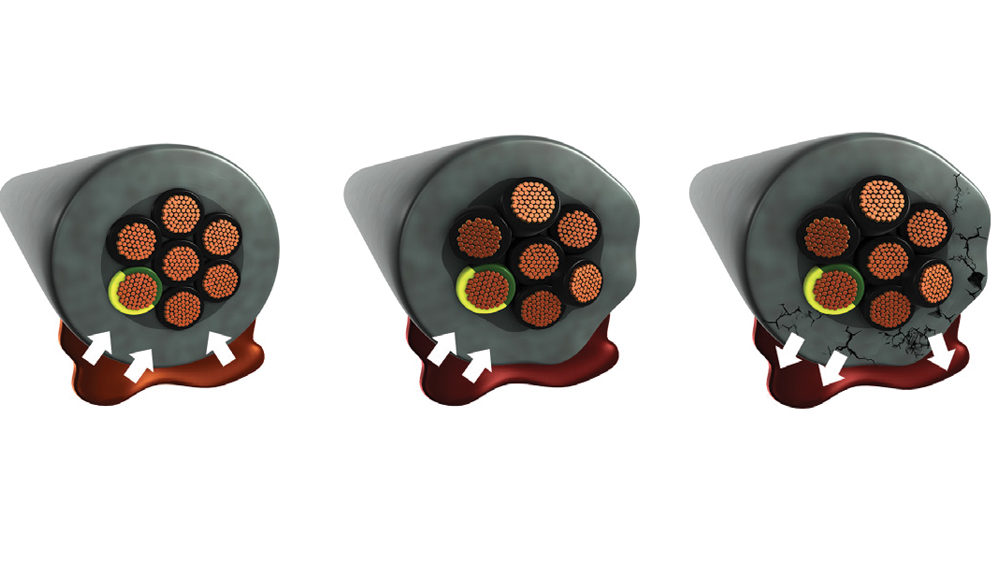

“It is too early to say good or bad. But I believe, this will certainly lead to the smooth and transparent business transactions. I think nothing has changed drastically in engineering sector after GST implementation. There is as lowdown currently but it will not last long. It does have some teething troubles, which will be resolved in the coming days,” says Vivek Nanivadekar, Executive Director, Fibro India Precision Products Pvt Ltd.

He adds, “One major change we experienced is that transportation time. Earlier any truck or tempo used to cover the distance of 300 – 400 kms per day; now after GST covers 600—700 kms. As there are no obstacles or stopping on the way. This increase in efficiency has been noticed with road or air courier services also. So, supplier is happy and the customer too. To me, it is the major positive change for industry.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.