Indian Machine Tools: Defending the defence sector

By OEM Update Editorial April 13, 2019 12:49 pm IST

Post privatising India’s defence sector, Indian machine tool industry is revisiting its capabilities and adding new products and solutions to meet cardinal demand. The industry, here, discusses what it takes to serve the Indian defence sector.

Industries are investing in R&D and innovation and developing sophisticated and high precision technology to meet the requirements of India defence industry and finding lucrative business overseas.

Privatising India’s defence sector

The government in the 2017-18 year started to privatise the Indian defence sector. In February 2018, Department of Industrial Policy & Promotion (DIPP) issued 348 licenses to 210 Indian Companies for the manufacturing of various licensable defence items.

Mayank Patel, R&D Head, SLTL Group says, “The DIPP is a solid boost to the industry which will see major a flow of Foreign Direct Investments (FDI) and overseas companies to make technological collaborations with domestic companies. This will strengthen the defence and military industry by bringing in the more advanced technology and advanced artillery.”

Privatisation of defence sector augurs well for India’s manufacturing sector. It will open up avenues for investments in defence equipment production. Indian machine tool manufacturers have been supplying technology and solutions for defence production. V. Anbu, Director General & CEO, IMTMA says, “With Government of India ushering 100 per cent FDI in defence equipment (through government approval), many off-shore defence equipment manufacturers will be setting up their base in India in collaboration with Indian industries.”

Privatisation can be a game changer for the manufacturing sector however, management will be challenging. This will also generate healthy competition, creating an ecosystem of self-improvement in technology, raising the bar of the general standards of manufacturing in India.

T K Ramesh, MD and CEO, Micromatic Machine Tools confidently says, “Consequently, via privatisation, Make in India will get a boost, new manufacturing technology will come into the country and also appropriate technology in this area will develop with the help of joint ventures and tie-ups. Specifically, tier 1 and 2 will have to make a substantial investment which will thereby help the machine tool sector.”

Mohini Kelkar, Director (Sales & Marketing) Grind Master Machines Pvt. Ltd. says, “There are cases where sourcing of several items for regular use in defence sector can be sourced from MSMEs in India. It is also a government mandate to do so, however in practice, it is not happening. On the other hand, there are private sector companies who have proactively invested in manufacturing technologies and developing defence related parts, are still waiting for orders from defence so as to make such investments viable.”

Private companies will be able to innovate and produce defence equipment faster as well as better in the near future. Announcement of the SP programme, will create an efficient supply chain that involves tier 2 and tier 3 companies to be involved in the manufacturing process. Vineet Seth, Managing Director – South Asia & Middle East, Mastercam APAC says, “It is a known fact that we (India) are the largest importer of defence equipment (arms). It is no doubt a certainty that Make in India opportunities will increase significantly, as a result of this decision. Our dependence on imports and supply delays of the past will be overcome with this initiative.”

The impending technology gap and transfer of technology In terms of manufacturing technology, we are a mature nation. We have access to the best manufacturing technology in the world through companies that now have direct presence in the country. Seth says, “The aerospace offset programme has educated us quite a lot in the past decade or so and we should be able to make efficient use of transfer of technology in the defence programme as a result. Considering the size of our market and consumption, I’m certain, that a healthy competitive industry will come up with participation of most leading defence manufacturers in the world.” Anbu says, “The country needs to use indigenous R&D agencies to their full potential. In India, the Defence Research Development Organisation (DRDO) and Defence PSUs are the key players playing a vital role through their wealth of R&D.” Combining the strengths of domestic agencies like these with strategic foreign collaborations for risk sharing and achieving a common goal of technological superiority will enable India to break technology gap barriers. This will facilitate transfer of technology and capture global market in key areas. Indian defence industry will be able to deliver systems which its defence forces can handily use for their key operations.

One of the key challenges, however, in the Indian defence manufacturing scenario is that technology is not easily shared. But another issue to address is that we are far behind in the technology front from our international counterparts. Ramesh says, “India’s experience with defence manufacturing has been strictly with the government bodies and imports. There will be a need for heavy investments in manufacturing competence to catch up with the changing scenario. But the change is good and much needed, which will push for more investments in machining and equipment from the country.”

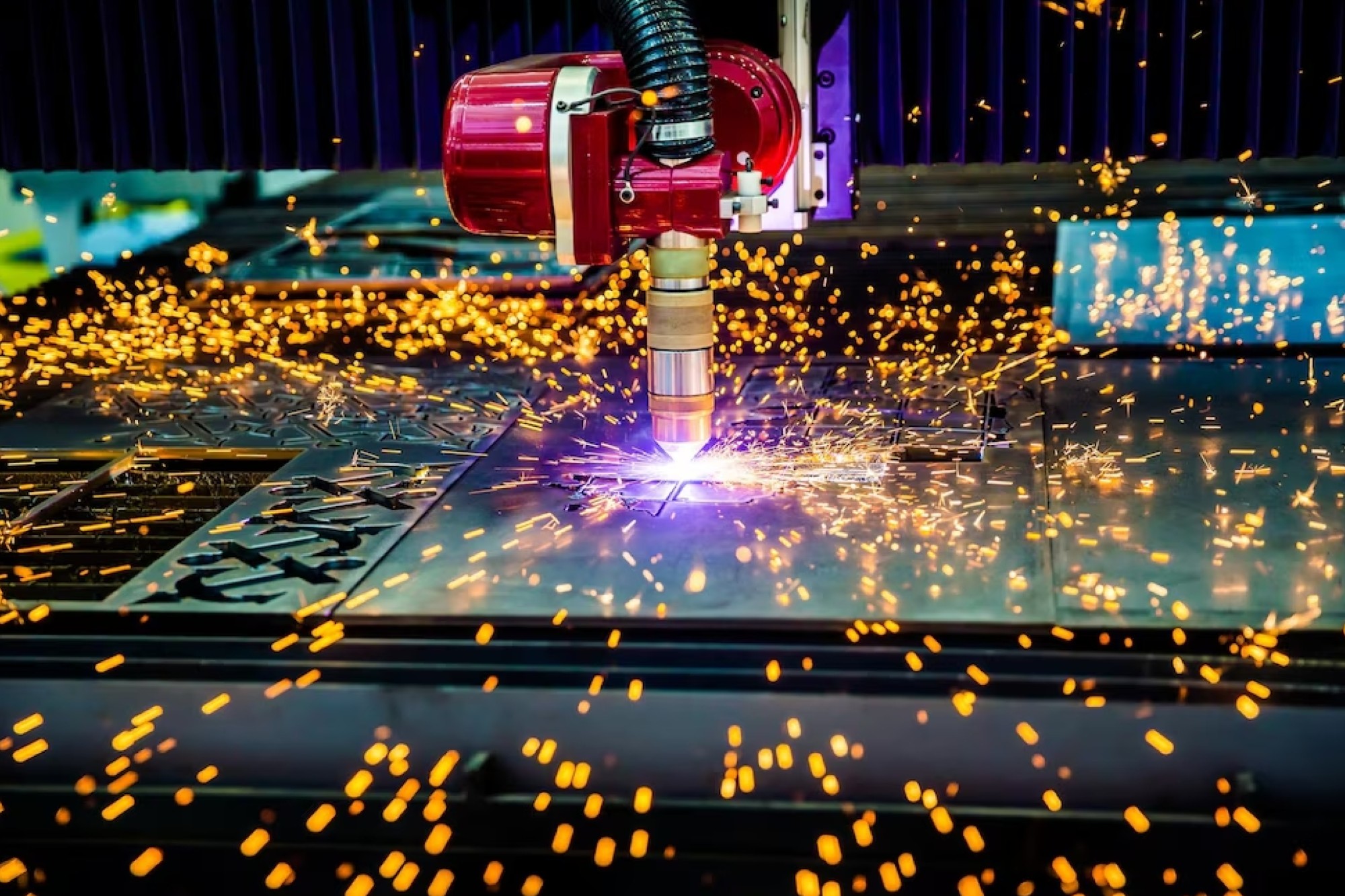

Manufacturing specific parts in the defence program also need different technology which is not available in India; for example, Flow forming Technology. Kelkar says, “It will be necessary that Indian companies collaborate with providers of such technologies and support manufacturing programs. Also, such manufacturing will need specialised solution providing approach which has to be developed.”

Patel says, “In a way to look at the gap, is a very complex fundamental perspective. If you look at the performance of the domestic sector, it has been notable, though when we look at the global progress in the technology, it has been phenomenal. That is because of the collaborative approach these overseas countries have adopted.” There the public and private sectors coming in together and keeping channels of international collaborations open to transfer the resources and technology to produce excellent defence equipment. Now, with the gates open with Strategic Partnerships (SP) approach, the technology gaps are looking to be overcome in defence programme.

Machine tool future with Bharat Stage 6 (BS6) emission normsBharat Stage VI (BS VI), an emission standard, will bring much-needed changes to the Indian automobile industry in terms of pollutant emissions. With this emission norm coming into effect, India will come at par with the US, European countries and other advanced automotive markets across the globe.

Patel says, “To keep both PM and NOx level under check, the OEMs would require diverse technologies to work in tandem. The shift to BS VI is a turning point for OEMs and auto part manufacturers. The challenge also presents opportunities for us to enhance each other’s capabilities by joining forces.”

The move is going to call for higher tolerance in component for more efficient fuel combustion and effective waste disposal. Ramesh says, “The need for higher performance machine is being pushed which will catalyse and call for very high process capabilities from machines and equipment. The development should be on machines, tooling and the entire manufacturing process for stability and gearing up for higher volume production of high-quality components.”

Industry will need to adapt to the changing times. Manufacturers will need to change engine technology. This will require re-tooling and the demand for related machinery will increase. Simultaneously the need for light-weighting will remain and so wherever it is possible the re-design must lead to lower weight. Anbu says, “We need better machines and industry units for this to upgrade their machines since demand will come from auto and auto component manufacturers to implement the changes needed to meet BS6 norms.”

Machine Tools companies will have to devise new processes which will be necessary to manufacture the new specifications on the part drawings that will come due to BS6 Emission norms. E.g. the finish level and geometric accuracies on the Engine and Transmission shafts will be much higher and different than previous levels. Kelkar says, “Grind Master has experience on working on such higher levels of finishing since we worked on such jobs from Global Auto OEMs outside India.”

Seth says, “BS6 norms ask for better emission control. Moving from the current BS4 to BS6 will most certainly entail significant changes to the manufacturing process of each platform for Automotive OEMs.” On board diagnostics being made mandatory in BS6, it would certainly mean an increased consumption of machine tool and allied technologies for the same.

Public and private sectors are coming together to transfer the resources and technology to produce excellent defence equipment.

Mayank Patel, R&D Head, SLTL Group

The DRDO and Defence PSUs are the key players playing a vital role through their wealth of R&D.

V. Anbu, Director General & CEO, IMTMA

Moving from the current BS4 to BS6 will most certainly entail significant changes to the manufacturing process of each platform for Automotive OEMs.

Vineet Seth, Managing Director – South Asia & Middle East, Mastercam APAC

Private sector companies investing in manufacturing defence related parts are still waiting for orders from defence so as to make such investments viable.

Mohini Kelkar, Director (Sales & Marketing) Grind Master Machines Pvt. Ltd

Tier 1 and 2 compnies will have to make a substantial investment to help the machine tool sector.

T K Ramesh, MD and CEO, Micromatic Machine Tools

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.