Die & mould:Booming in India

By OEM Update Editorial April 12, 2018 12:03 pm IST

An exclusive report on how die and mould industry is striving for growth.

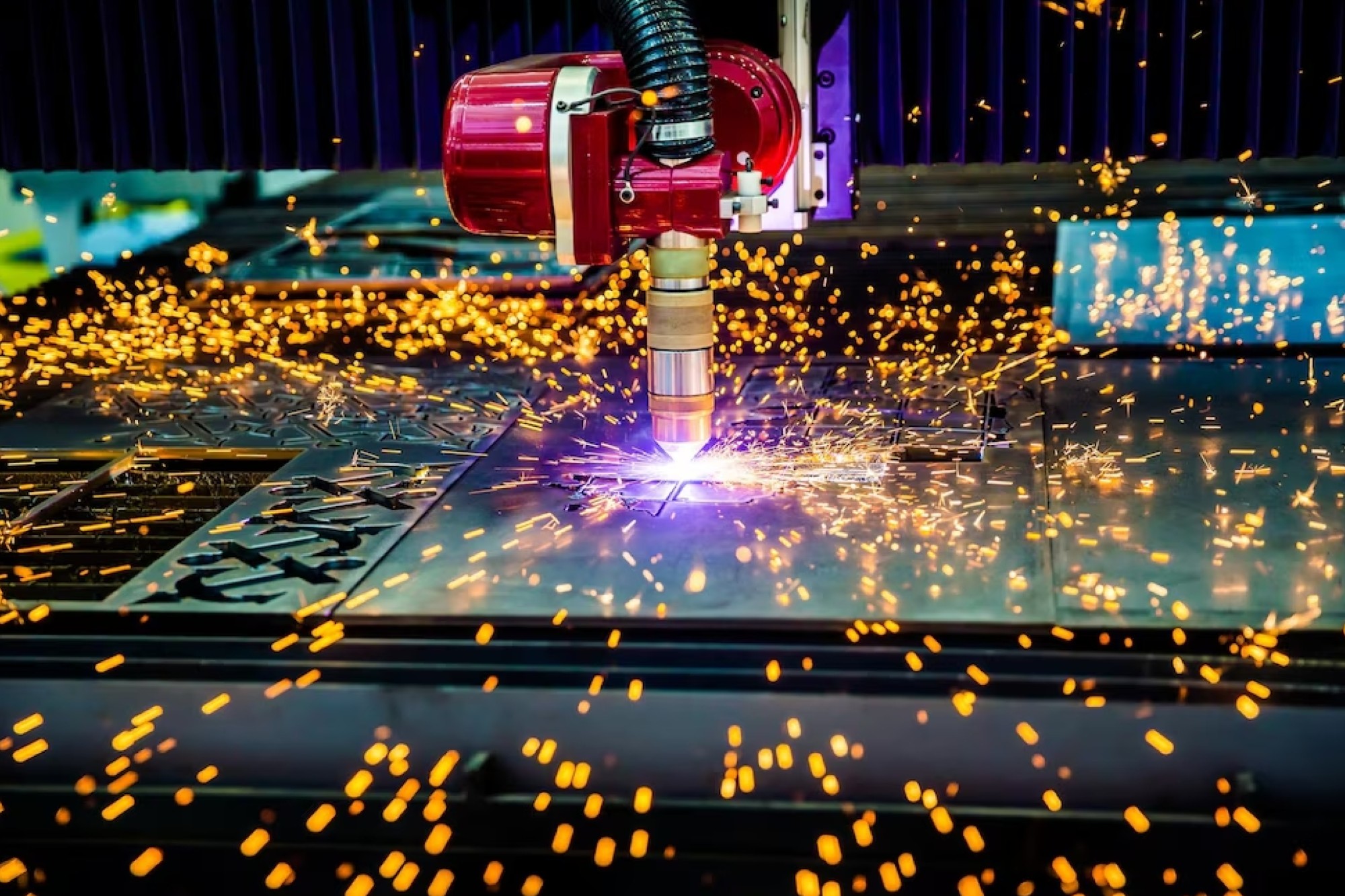

The die and mould industry in India has evolved over the years and today has been a major contributor in Indian economy. Die and mould plays a pivot role for most of the manufacturing industries like auto components, packaging, plastics, electronics, electrical, healthcare, machine tools, etc. Here’s an analysis on the status of die and mould industry in India, its potential, major growth drivers and various challenges faced.

Die and mould industry is getting matured every year

According to K. Manickam, Managing Director, CAD Macro Design and Solutions Pvt Ltd, as the mother industry of all manufacturing verticals, definitely Indian die and mould industry deserves a promising market size and growing consistently in the past 3 decades by taking up the advantages of globalisation. He adds, “In fact, the changing technology trends in the vertical, integrated approach in the overall production, improved tool room management systems are the key factors in speeding up the growth status of this industry and converging Indian tool room market as a promising sector. Indian die and mould industry is getting matured with an average growth of 12 per cent to 15 per cent every year with consistent development on capacity building and international standards.”

Estimated to grow at about 16.28 per cent CAGR

Raju Battula, National Manager – Technical Support, DesignTech Systems Ltd, says, “The die and mould market in India is estimated to grow at about 16.28 per cent CAGR of during 2013-2018. This has largely been an unorganised and geographically scattered sector. However, they are slowly migrating away from traditional development methodologies and embracing the proven new and modern approaches and technologies for machining, manufacturing and allied developmental activities. These new age technologies such as 3D modelling software, CAE software solutions, CAM solutions, 3D Printing technologies, etc will give them the competitive edge by helping them optimise their working processes and resources, better the products quality and that too in reduced turnaround time and costs.”

He adds, “With many of the suppliers working with large tier 1 companies or directly with the OEMs, they are now a part of their networked and integrated communication systems like PLM, CRM, SCM, ERP which has brought in more discipline and streamlined approach to their working processes. This has compelled them to adopt and adapt to the new technologies and systems of better management, administration, products development, communication and sharing knowledge.”

Quality and lead time- are the major issues

There are very few commercial tool rooms in India but many small and medium scale tool makers exist in the country. Vivek Nanivadekar, Executive Director, FIBRO India informs, “The quality meeting global standards and the lead time are the major issues faced by the local die and mould making industry which we need to overcome. The new large investments are not seen coming thru. This could be due to majority of tool makers are small and medium size. We need to double the capacity considering the growth prospects. We have good training institutes which deliver few hundred tool makers every year but not everybody finds the right job.”

However, Nanivadekar feels that the silver lining is the initiative taken by the government for the SME sector. In fact the new classification of MSME based on the turnover and not on the investment proposed by the government should make positive impact on the die and mould making industry as well.

Highlighting the growth potential in India

Enormous potential in coming years

Sanjib Chakraborty, Managing Director, Hurco India informs, “India has already registered as fastest growing economy in the world and is capable to maintain the position with expected growth rate of 7 per cent plus in coming years. So there will be strong demand in manufacturing sector. The Indian die and mould industry is mainly driven by automotive industry. When government of India aims to make automobile manufacturing (passenger car) the main driver of ‘Make in India’ initiative with a 3 times growth target by 2026, then the growth potential is enormous. So, one shouldn’t focus on the short-term high point and low point of the growth curve. Instead one should look at the large numbers for India having enormous potential in coming years.”

According to the Indian tool room manufacturing forums, the domestic average market size of die and mould industry could touch around Rs 30,000 crore by 2021 from its current average market size of Rs 18,000 crore. The proposed growth definitely demands a sustained relationship among the research forums, government bodies, trade associations and the policy makers in a right mix towards next level growth.

Manickam states, “As the proposed average market size of health care sector is around 27 billion USD by 2030, it is evident that thousands of MSMEs would grow accordingly. Apart, the major sectors like automotive, consumer electronics, infrastructure development, mass engineering projects and national energy development road maps would support Indian die and mould industries to win over substantial growth in the years to come.”

Die and mould industry: set to boom manifolds

Companies in die and mould industry cater to companies from cross vertical domains including automotive, industry machinery, consumer goods, heavy engineering and many more. Battula says, “With the government of India focussing increasingly on ‘Make in India’ initiative, this industry is set to boom manifolds in the coming years. Other factors set to make positive impact on this sector are initiatives such as, dedicated SEZs for aerospace manufacturing, ease-of-doing business policy reforms, encouraging greater FDIs, overall infrastructure development, promoting and forming dedicated engineering clusters, skill development initiatives that will ensure availability of trained manpower to do the specific jobs etc. These efforts would enormously provide the greater thrust to this industry making it one of the key growth contributors to the manufacturing industry GDP in India.”

All set to meet new growth challenges

Ram Grover, Managing Director, Elesa and Ganter India Pvt Ltd, says, “With a positive recovery trend in the overall economy and tremendous growth prospects possible with government’s focus on manufacturing growth the Indian die and mould industry is poised to meet the new growth challenges.”

He adds, “Die and mould makers in India can today confidently compete with the global market and over the years have recorded phenomenal all-round market growth. Die and mould associations in India is looking forward to gain engineering excellence with an aim to establish India as global manufacturing hub. With globalisation benefits, we are seeing qualitative improvement in the type of moulds being used in various industries. It is a highly competitive industry but the opportunities are plenty as well.”

Featuring the major growth drivers

‘Make in India’ initiative

Nanivadekar says, “The good sign is that the import of die and mould is decreasing and local manufacturing is increasing, as per the recent survey conducted by TAGMA. The overall die and mould market is expected to grow by 10-15 per cent for the next three years. Secondly ‘Make in India’ initiative taken by the government will give further boost. Many of the auto OEMs have responded positively to this drive and decided to increase the contribution of local manufactured components.”

He opines “We cannot neglect the international market. The couple of advanced countries are likely to stop manufacturing die and mould for two reasons competitiveness and non availability of skilled manpower. On the other hand, the current destinations of die and mould makers have started facing the above two problems. This situation opens up the doors of international markets for Indian tool makers.”

Automotive industry: The major growth driver

The automotive industry is the main growth driver for Indian die and mould industry. Chakraborty says, “The consistent growth in automobiles with launching target of new products within a short period increased the demand in multi scale in last couple of years. Most of the customers started sourcing 100 per cent mould from India and also opened the flood gate for export to their other overseas division. Beside that the increase in purchasing capacity of rural and urban India will boost the growth in manufacturing sectors of auto components, packaging, plastics, electronics, electrical, healthcare and machine tools. It is directly proportionate as a growth factor for die and mould industry.”

Potential growth drivers

The current demand of die and mould are met out as 60:40 percentage in terms of its import; Domestic Production Mapping (DPM), rational moves in this sector could still reduce the importing stream and would eventually improve the domestic contribution of Indian tool rooms. Manickam explains, “As explored earlier, manufacturing process related to automotive sectors or any mass engineering products would require integrated approach in the tooling industry to ensure optimised costing, improved efficiency and advanced forecasting in all the phases. In addition, inclusion of 3D Printing for prototyping, precision machining, rapid tooling systems and utilisation of advanced CAM tools are the potential growth drivers in the Indian die and mould sector.”

Investment plan should be wider and deeper prospective

Chakraborty informs, “There are lots of challenges but it is not from outsiders. These are within our own die mould community. With the globalisation of the Indian manufacturing industry, we are seeing a qualitative change with increasing complexity of the product profiles and higher accuracies, coupled with demand for extremely fast deliveries.”

He adds, “Today’s die and mould industry need highly efficient processes, machine and management system. Our investment plan should be wider and deeper prospective.”

Critical business factors

The critical business factors like global competency, thin margin and reduced delivery time are crushing the die and mould industry to operate more rational. Manickam informs, “Eventually, this becomes the critical challenge of the industry as the said operational pressure demands high degree of co-ordination, precious design and advanced programming inputs across all the phases.”

He adds, “Availing skilled labour, poor utilisation of manpower and machines, lack of advanced monitoring and scheduling tools and unorganised approach in the overall production are the key threats of the sector immaterial of its conceived growth in its landscape.”

Open to adopt the latest technologies

Battula states, “Die and mould sector still largely relies on their experience based traditional ways of products development and manufacturing. They will have to be open to adopting the latest technologies to stay attuned to the current industry working trends. Availability of skilled and trained manpower to best leverage the technologies to derive greater benefits is another concern. Arranging for capital to be invested in modern technology is also a challenge.”

Lagging in international quality

The infrastructure in terms of availability of raw materials and lack of standardisation are the stumbling blocks in reducing the lead time of the tools. Nanivadekar said, “I am sure the healthy competition and increasing demand will improve the situation over a period of time. Another big challenge is the international quality in which we are lagging. We need to look at this seriously. I am confident that the more exposure and the experience will make us reach there.”

Industry’s performance

High-end technology is getting good response

Hurco started the journey in 1968 with a mission to provide unique and innovative software and control system to help customers to maximise the productivity and profit. Five decades later, the original mission statement is still the cornerstone of 21st century Hurco. The company has started promoting the high end technology in India and is getting very good response. The population of 5 axis machine, multi axes machines, high performance die mould machine and large double column machine increased substantially in last couple of years. Chakraborty says, “We always addressed customer’s concern to make customer more competitive. Our latest innovation is 3D printing technology on 3 axis VMC will help customer in prototyping task on the same machine. And also 3D DXF transfer software which will reduce the dependency on cam software to large extend.”

Supporting the tool rooms for more than a decade

Considering the current challenges of die and mould industry, CAD Macro Design have been consistently supporting the tool rooms for more than a decade by supplementing them various CAM tools for wire EDM, lathe, nesting and press tool design segments. By considering the critical gap existing in the overall delivery cycle of die and mould industry, the company came out with a comprehensive tool room management system in the form of an ERP tool which effectively compliment the complete delivery cycle starting from order, purchase, scheduling, resource management, data analysis, maintenance, dash boards and integrated management reports. Manickam says, “By and large, in our decade long journey, we are complimenting CAM tools and tool room ERP system to our clients thereby enabling them with improved margins and effective resource management.”

Promoting the use of technologies to the engineering sector

DesignTech Systems Ltd promotes the use of CAD/CAM/CAE, PLM and additive manufacturing technologies to the engineering industry in India. The company in association with Siemens Industry software entered into MoUs with various states governments of India including Gujarat, Andhra Pradesh, Karnataka, Tamil Nadu and Jharkhand to set up Siemens Centres of Excellence to train the students on the latest products development and manufacturing technologies from Siemens. Being into engineering services, DesignTech Systems work closely with the mechanical and products development companies in India and overseas as their extended R&D teams, making valuable contributions to their engineering initiatives. In the recent past the company has set-up a joint venture with Integrity Mould tool and Die Inc., as their products design and engineering partner. Battula asserts, “For Dassault Systèmes, we are the largest CATIA certification partner in India. Established in 1998, today we have customers over 2,200 together in India and overseas and have been consistently growing at about 20-25 per cent every year, making us a leader in products development technologies suppliers, engineering services providers and PLM training offerings in India.”

Increasing new machines to meet market demand

Nanivadekar informs, “It was the mixed year. Though we did not achieve our targets but we did better than the last year. We introduced few new products like spring plunger, guide posts, CAM units etc in the standard parts range where as we started construction of our new plant to be dedicated to rotary tables. We hope to complete the construction and start manufacturing of rotary tables for the world market by July 2019.”

FIBRO has added couple of new machines to increase the capacity to meet the anticipated increased market demand and has added more than 50 new customers. The company has increased the stock of fast moving products so as to deliver them to the customers with the short notice.

Indian die and mould industry is getting matured with an average growth of 12 per cent to 15 per cent every year with consistent development on capacity building and international standards.

K. Manickam, Managing Director, CAD Macro Design and Solutions Pvt Ltd

With the government of India focussing increasingly on ‘Make in India’ initiative, this industry is set to boom manifolds in the coming years.

Raju Battula, National Manager- Technical Support, DesignTech Systems Ltd

The quality meeting global standards and the lead time are the major issues faced by the local die and mould making industry which we need to overcome.

Vivek Nanivadekar, Executive Director, FIBRO India

Today’s die and mould industry need highly efficient processes, machine and management system. Our investment plan should be with wider and deeper prospective.

Sanjib Chakraborty, Managing Director, Hurco India

Die and mould makers in India can today confidently compete with the global market and over the years have recorded phenomenal all-round market growth.

Ram Grover, Managing Director, Elesa and Ganter India

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.