Track and Trace Solutions market to expand at 19% CAGR

By OEM Update Editorial November 9, 2021 1:39 pm IST

The global track and trace solutions market size was valued at USD 2.5 billion in 2020 and is expected to expand at a compound annual growth rate of 19 percent from 2021 to 2028.

The advantages such as continuous transparency, packaging and logistics management, and product ID verification services facilitating hassle-free product movement within the distribution channel is the key growth driver for the track and trace solutions market.

The companies are adopting track and trace solutions for supply chain monitoring. The growth of the market for track and trace solutions is anticipated to be fueled by the rising deployment of track and trace solutions by pharmaceutical and medical device companies. It has been found that the influx of substandard/counterfeit medications is more prevalent in low to middle-income countries such as India and Africa.

Moreover, stringent regulations and standards pertinent to serialisation implementation and aggregation are expected to drive the market for track and trace solutions. However, the high cost connected with the track and trace implementation, and lack of unified global standard regulations for serialisation and aggregation could hinder the growth of the market for track and trace solutions.

Product overview

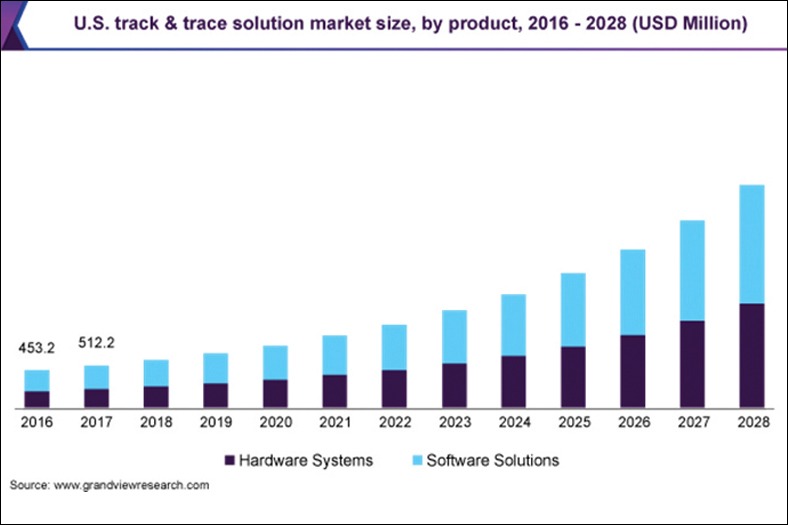

Software solutions segment dominated the market for track and trace solutions and held the largest revenue share of over 54.0 percent in 2020 due to its growing adoption in healthcare companies, including pharmaceuticals, biopharmaceuticals, and medical device companies. These software solutions are used for continuous management of manufacturing facilities, product lines, case and bundle tracking, and warehousing and shipping. Companies developing this software are investing in R&D for better product development which is expected to propel the growth.

Hardware solution segment is expected to show lucrative growth over the forecast period. The printing and marking solutions segment held the largest revenue share in the market. This system plays an important role in the production and supply chain to ensure quality and product authenticity. Rising demand for serialisation and the need to achieve regulatory compliance is fueling the market growth. Printing and marking equipment is expected to play a crucial role to meet the Drug Supply Chain Security Act (DSCSA) requirements by 2023. Moreover, advancement in coding technologies such as laser marking systems, Large Character Marking (LCM), and Thermal Transfer Overprinting (TTO) is expected to fuel the market in the coming years.

Application solutions

Serialisation solutions segments dominated the market for track and trace solutions and held the largest revenue share of over 56 percent in 2020 due to the increasing focus of regulatory bodies on the implementation of the same. The federal agencies, country governments, and healthcare industry are taking measures to decrease product diversion and drug counterfeiting. Serialisation is a major step to comply with new ePedigree regulations that are required for product traceability during the supply chain. In addition, the increased focus on patient safety and brand protection by manufacturers is expected to propel the segment growth during the study period.Technology insights

The barcodes technology segments dominated the market for track and trace solutions and accounted for the largest revenue share of over 84 percent in 2020. The 2D barcode is the dominant segment of the barcode technology and is expected to maintain its position throughout the study period.

In addition, ample data storage capacity of 2D barcodes than linear barcodes, as well as its higher popularity in the industry boosts the demand for 2D barcode-based solutions. Government regulations and an increase in counterfeit drugs sale led to the implementation of barcode technology in the healthcare industry. The demand for barcode technology in the track and trace solutions market is expected to remain high during the forecast period.

Regional growth

North America dominated the market for track and trace solutions and accounted for the largest revenue share of 38 percent in 2020, primarily due to the presence of highly regulated serialisation and aggregation standards, as well as advanced healthcare infrastructure. Europe is the second-largest market for track and trace solutions in terms of revenue share and is expected to remain unaltered till 2028. They can be attributed to the presence of developed economies, such as Germany, Turkey, the U.K., France, and Italy, in the region. According to the Falsified Medicines Directive, manufacturers failing to comply with drug serialisation regulations would not be allowed to market their products in Europe.

Market strategy

There are multiple small and large manufacturers offering products for tracking and tracing applications, resulting in intense competition among vendors. The vendors are increasing their focus on strategic partnerships with their consumers and are collaborating with others players in the sector. For instance, in January 2021, OPTEL partnered with Bureau Veritas and introduced a V-TRACE traceability solution for the management of COVID-19 vaccine supply chain logistics. Furthermore, in June 2020, Zebra Technologies Corp. introduced Zebra Motion Works Proximity which features proximity sensing at the user level that permits alerting and contact tracing. This initiative is expected to help the company to increase its market footprint.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.